salt tax cap explained

December 12 2021 930 AM 4 min read. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How does the property tax deduction differ from the overall SALT deduction.

. The Tax Cuts and Jobs Act. The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025. But some policymakers are pushing to get rid of it.

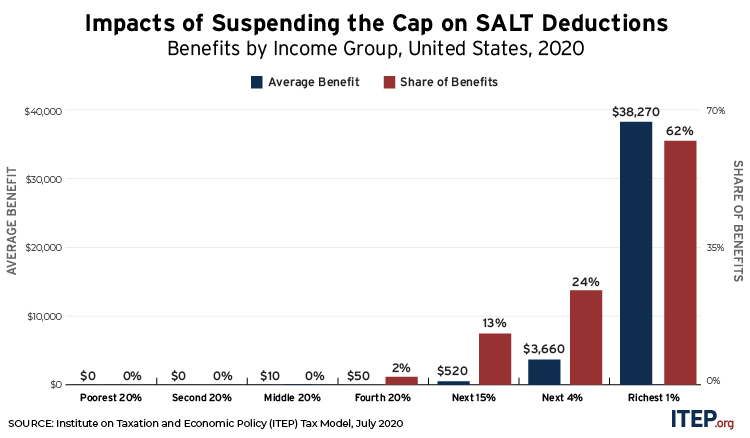

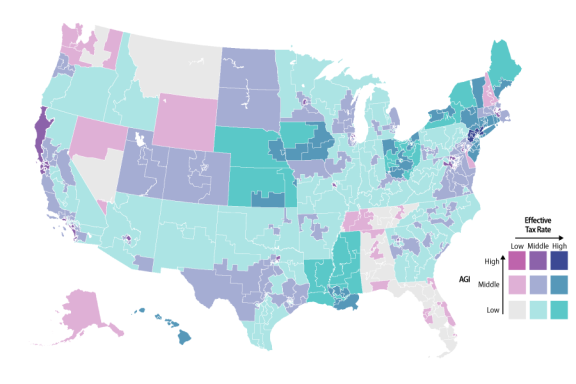

Higher-tax states such as California New York New Jersey and Pennsylvania. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. Now the SALT tax cap is set to expire in 2025.

Leaders are trying to. As incomes rise the loss in deductions can also be offset by the decrease of the top federal income tax rate from. How to lower your chances of an IRS tax audit 0252.

The SALT deduction tends to benefit states with many higher-earners and higher state taxes. Ways the SALT deduction cap can be offset for high earners. As for the House bills 10000 cap on the property tax deduction the average deduction claimed.

About 256 million fewer tax returns used the SALT deduction the year after the cap was put in place. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. This was true prior to the SALT deduction cap and remained the case in 2018.

Taxpayers who are impacted by the SALT limitthose taxpayers who itemize deductions and who paid state and local taxes in excess of the SALT limitmay not be. As alternatives to a full repeal of the cap lawmakers and. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. Given that 10000 cap on the SALT deduction you would need to find more than 2200 in deductions elsewhere to. The federal tax reform law passed on Dec.

As I explained in Part 1 last week a majority of states now allow pass-through entity PTE owners to get around the federal 10000 state and. This cap remains unchanged for your 2021 taxes and it will remain the same in. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT.

Published Sep 13 2022. The rich especially the very rich. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

New York Enhances Salt Cap Workaround For Pass Through Businesses Accounting Today

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

What Is The Salt Deduction And How Does It Work

The Price We Pay For Capping The Salt Deduction Tax Policy Center

What Is The Salt Tax Deduction Forbes Advisor

Virginia Salt Cap Workaround Hantzmon Wiebel Cpa And Advisory Services

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

The Salt Cap Overview And Analysis Everycrsreport Com

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The State And Local Tax Deduction A Primer Tax Foundation

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

Ohio Income Tax Ohio Jumps On Trend To Codify Salt Deduction Cap Workaround Buckingham Doolittle Burroughs Llc Jdsupra

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Rsu Taxes Explained 4 Tax Strategies For 2022

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times